BI Announces New Policies to Support Govt New Economic Policy Package

BI Announces New Policies to Support Govt New Economic Policy Package

In a bid to support the First Phase Government action announcing the Economic Policy Package of September 2015, Bank Indonesia (BI) as the monetary authority also introduced new policies in September 2015.

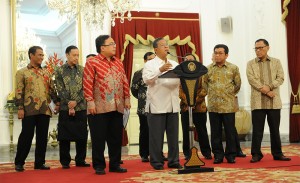

The new policies are the ones that have been coordinated with the Government particularly, the Central Government and related authorities especially Minister of Finance, BI Governor Agus D.W. Martowardojo said while announcing the policies after President Joko Widodo announced the First Phase Policy Package of September 2015, at the Merdeka Palace, Jakarta, on Wednesday (9/9) afternoon.

According to Agus, there are 5 (five) things prepared by Bank Indonesia in September 2015.

- Strengthening inflation control and supporting real sector in economic supply.

- Strengthening coordination of TPI (Inflation Control Team) and Regional Inflation Control Team (TPID) to accelerate the implementation of the national and regional inflation control roadmap.

There are currently more than 430 TPI all over Indonesia which have already had inflation control roadmap. We want to ensure that a good coordination will be done for the implementation, Agus explained.

- Strengthening cooperation in economic and regional finance between Bank Indonesia, the Central Government and regional governments to ensure that the economy and the finance in the region can follow the central government.

Coordination is required among Bank Indonesia, the Central Government, and regional governments, the Governor said.

- Strengthening stabilization of the exchange rate

- Maintaning market confidence for foreign exchange market through a control of exchange rate volatility;

- Maintaining market confidence for Indonesias state securities (SBN) through a purchase in secondary market by paying attention to the impacts of the availability of state securities on inflow and liquidity of money market.

- Strengthening rupiah liquidity management.

- Changing auction mechanism of state securities reverse repo from rate tender variable to fixed rate tender, adjusting pricing reverse repo of SBN and extending the tenor by issuing reverse repo of three-month SBN.

- Changing auction mechanism of BI deposit certificate (SDBI) from rate tender variable to fixed rate tender, adjusting pricing of SDBI and issuing SDBI of six-month tenor.

- Re-issuing BI certificate of 9-month tenor and 12-month tenor through auction mechanism of fixed rate tender and pricing adjustment.

4. Strengthening management of supply and demand of foreign exchange.

- Adjusting auction frequency of foreign exchange swap from twice a week to once a week

- Changing auction mechanism of foreign exchange term deposit from rate tender variable to fixed rate tender, adjusting the pricing and extending the tenor until three months.

- Lowering foreign exchange purchase limit by proving the underlying document from US$ 100 thousand to US$ 25 thousand per month per customer and giving an obligation to use tax identification numbers (NPWP).

- Accelerating the approval process of foreign debt of Bank without ignoring the principle of prudence.

5. Further actions to deepen financial market

- Providing swap hedging facility to support infrastructure investment and strengthening foreign exchange reserves

Completing regulations on money market covering all components related to market development, among others instrument, maker, and infrastructure. (ES/Humas) (JS/EP/LW/Naster)