Economic Recovery Policies Increase KUR Disbursement in June

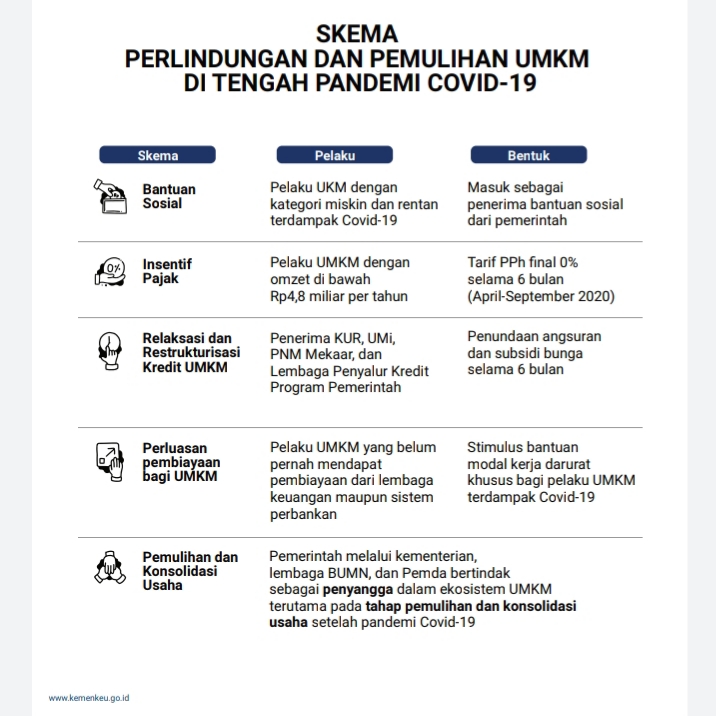

Micro, Small, and Medium-sized Enterprises (MSME) Protection Scheme amid COVID-19 pandemic. (Photo by: Ministry of Finance).

National Economic Recovery Policy and economic activities which have been resumed in ‘new normal’ era bring positive impacts to the national economy, marked by an increase in Smallholder Business Credit (KUR) disbursement and increase in manufacturing Purchasing Managers Index (PMI) and domestic demand in June 2020.

According to data from Bank Rakyat Indonesia (BRI), the BRI was focused on credit restructuration in April 2020 (79.4 percent) and May 2020 (82.7 percent). Starting from the third week of June 2020, the Bank has expanded micro credit disbursement to 78.2 percent, while credit restructuration only at 21.8 percent.

In the third weekend of June 2020, the total expansion of micro credit has exceed Rp1 trillion per day or almost equal to credit disbursement as usual. For the record, BRI is the biggest national payment bank that has disbursed 64 percent of the KUR.

“We expect the condition can be maintained so that disbursement of national credit can be expanded and national economic recovery can be made immediately,” Coordinating Minister for Economic Affairs Airlangga Hartarto said on Wednesday (1/7).

The Coordinating Minister explained that the Government continues to maintain the health of the people while recover the national economy during the pandemic. Budget allocated for National Economic Recovery program amounting to Rp607.65 trillion is expected to be able to maintain purchasing power of the people and reduce the impacts of COVID-19 to the economy.

The program consists of social protection amounting Rp203.90 trillion, business incentives amounting to Rp120.61 trillion, assistances for Micro, Small, and Medium-sized Enterprises (MSMEs) amounting to Rp123.46 trillion, corporation financing amounting to Rp53.57 trillion, and budget for ministries/institutions and the regional governments amounting to Rp106.11 trillion.

As for the MSMEs, the assistances are provided in the forms of interest subsidy, tax incentive, and collateral to take capital loan. Budget allocated for interest subsidies reached Rp35.28 trillion with a total beneficiaries of 60.66 million people.

“Relaxation of loan installment and interest subsidies for Micro and Small Enterprises covering 6 percent are provided for the first three months and 3 percent for the next three months. Meanwhile for medium-sized enterprises, interest subsidies of 3 percent is given for the first three months and 2 percent for the next three months,” Airlangga said.

To follow up the policy particularly the KUR policy, the Government through Committee for Policy Financing for the MSME has issued Regulation of the Coordinating Minister for Economic Affairs Number 6 of 2020 as lastly amended in Regulation of the Coordinating Minister for Economic Affairs Number 8 of 2020 on Special Provisions for Recipients of KUR affected by the COVID-19 pandemic.

In the Regulation, the Government relaxes loan installment and provides additional interest subsidies covering 6 percent for the first three months and 3 percent for the next three months, delays loan repayment, increases loan ceiling, and allows people to complete administrative requirements to apply for KUR later.

Based on a data, by the end of May 2020 the assistances provided by the Government has significantly benefited the debtors, through:

- Additional interest subsidies for the KUR that are disbursed to 1,449,570 debtors with a total debit balance of 1 trillion.

- Delay loan principal payment for six months that are provided to 1,395,009 debtors with a total debit balance of 7 trillion.

- Relaxation of loan installment that are provided to 1,393,024 debtors with a total debit balance of 9 trillion.

In general, disbursement of the KUR from August 2015 to 31 May 2020 has reached Rp538.82 trillion with a total debit balance of Rp158.84 trillion to 20.5 million debtors. In addition, KUR’s Non Performing Loan (NPL) as of 31 May 2020 was recorded at 1.18 percent.

Disbursement of KUR from January 2020 to 31 May 2020 has reached Rp65.86 trillion to 1.9 million debtors or 34.66 percent out of the target of 2020 which is at Rp190 trillion. The disbursement was slowed down due to the implementation of physical distancing, social distancing, and Large-scale Social Restrictions (PSBB) in several provinces that suspended the economic activity and affected the MSMEs that eventually decreased the number of KUR’s new applicants.

Nevertheless, new normal era and economic recovery policies has stimulated the economic activities. The policies are expected to develop the MSMEs including the disbursement of the KUR.

Recovery of economic activities also marked by an increase in domestic demand as eateries and restaurants are reopened since many companies start to resume work from office. The economic activities also stimulated transportation sector, marked by inflation which is sourced from transportation tariffs be it air transportation, intercity transportation, or online transportation.

Coordinating Minster Airlangga who is also the Leader of Central Inflation Control Team, expressed belief that national inflation rate in June 2020 is still low which is at 0.18 (mtm), 1.96 (yoy) dan 1.09 percent (ytd). He also expected the economic growth 2020 will be better than prediction of international agencies such as the International Monetary Fund (IMF) and World Bank. (Coordinating Ministry for Economic Affairs PR/EN)

Translated by : Rany Anjany

Reviewed by: Yuyu Mulyani