Finance Minister Tells Taxpayers to Report Annual Tax Return Through E-Filing

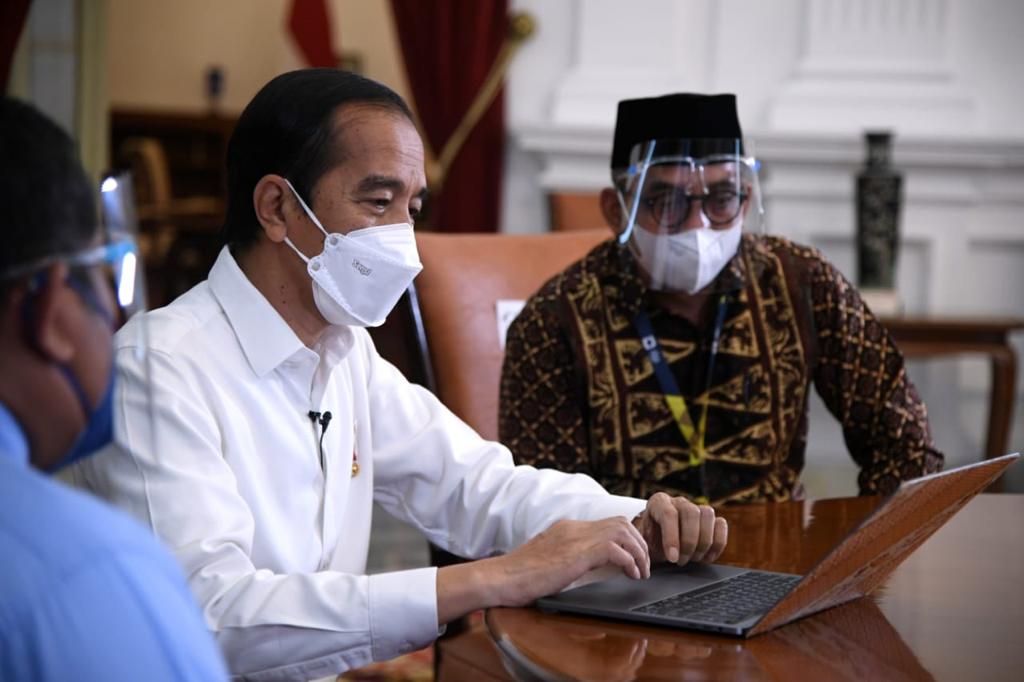

President Jokowi reports annual tax return online through e-filling application, at the Merdeka Palace, Jakarta, Wednesday (3/3). (Photo by: Presidential Secretariat Press Bureau/Lukas)

Minister of Finance Sri Mulyani Indrawati has appealed taxpayers to immediately file annual tax returns (SPTs) before the deadline on 31 March for individuals and 30 April 2021 for corporations.

“Do report the 2020 SPTs, especially for individual taxpayers. File them within this week, don’t wait until 31 March 2021. The deadline for corporate taxpayers will be in April, and certainly it can also be reported immediately,” the Minister said.

According to the Minister, taxpayers will not be subject to fines if they file their tax returns earlier before the deadlines.

Sri Mulyani also appealed taxpayers to file the tax returns online or through e-filling application to prevent the spread of COVID-19 transmission.

Data from Ministry of Finance’s Directorate General of Taxes shows that to date, the number of SPTs submitted has reached 5,152,006 with 96 percent of SPTs submitted via e-filing. The compliance with SPT submission is crucial for tax revenue and in the long term can also enhance the independence of the nation. The SPT submission rate is lower than that in 2020.

The SPT submission via e-filing can be carried out through www.pajak.go.id by selecting the Login menu in the right corner of the page. Before reporting the SPT, make sure the taxpayer has activated the Electronic Filing Identification Number (EFIN). The EFIN is an identification number issued by the Directorate General of Taxes for electronic SPT filling.

If taxpayers forget their EFINs, they can submit requests for forgetting EFIN services by attaching supporting documents through the Tax Kring Agent, WhatsApp phone/message to the official Tax Service Office (KPP) number, KPP official email, or Direct Message to KPP’s social media accounts where the taxpayer is registered. The official telephone number and e-mail of each KPPs can be seen on the link www.pajak.go.id/unit-kerja.

Kring Pajak agents can also be reached through telephone number 1500 200, mention to Twitter account @kring_pajak, electronic mail to informasi@pajak.go.id for tax information, email to pengaduan@pajak.go.id for complaints, or live chat on the tax site www.pajak.go.id every weekday (Monday – Friday) 08.00 a.m. – 04.00 p.m.

If taxpayers forget their passwords, they can reset the password by entering the tax identification numbers (NPWP), EFIN, and email data. Taxpayers who experience any issues reporting their SPTs can also contact the channels mentioned above for solutions. Ministry of Finance in this case Directorate General of Taxes will constantly strive to make various improvements through tax reforms so that the level of compliance in reporting the SPT is expected to increase every year. The taxpayer is expected to report the SPT fairly and properly as a manifestation of the taxpayer who also maintains the integrity of tax officials. (PR of Ministry of Finance/UN) (RIF/MUR)