Financial Services Authority to Improve Digitalization of Financial Sector

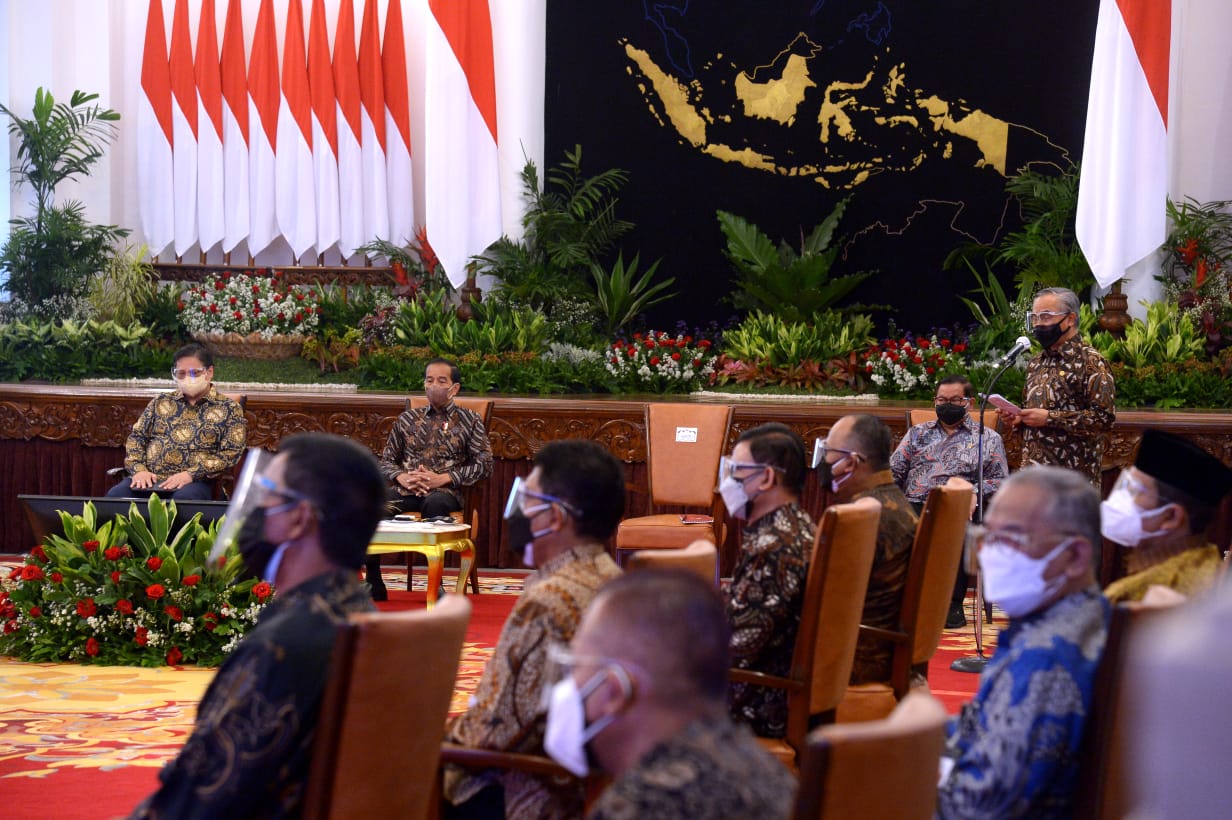

Head of OJK Board of Commissioner Wimboh Santoso delivers report during OJK Virtual Innovation Day 2021, Monday (11/10) at the State Palace, Jakarta. (Photo by: BPMI of Presidential Secretariat/Kris)

The Financial Services Authority (OJK) continues to accelerate digital transformation in the financial sector to improve the people’s financial inclusivity in order to revive the national economy.

Head of the OJK Board of Commissioner Wimboh Santoso made the statement, Monday (11/10), during the OJK Virtual Innovation Day 2021 at the State Palace in Jakarta.

“OJK’s policies in speeding up digital transformation in the financial sector are focused on two strategies, namely to provide fast, affordable, and competitive services and products to the people and to ease and expand access to utilize digital financial products and services for unbankable people and MSME players,” he said.

Wimboh stated that in order to improve digitalization in the financial sector, the OJK has issued various policies.

First, the OJK’s regulation on digital banks provide access for banks to enter a digital ecosystem and develop digital banking products and services for small-scale banks, such as Bank Perkreditan Rakyat (BPR/People’s Credit Bank). The same opportunities are also given to micro financial institutions, including micro endowment banks.

In addition, the OJK also provides a larger room for MSMEs to develop and be digitalized. According to Wimboh, the OJK is building and continues to build a digital MSME ecosystem that is integrated from the upstream to downstream.

“MSMEs are an important topic that we will handle so that they become a part of the digital ecosystem, starting from the technology of production, marketing, financing, to investment,” he said, adding that the digital MSME ecosystem will support MSME development in terms of financing through peer-to-peer (p2p) lending and securities crowdfunding.

As for the marketing aspect, the OJK continues to foster MSMEs by collaborating with start-ups and higher education institutions in building MSME campus that provides intensive trainings so that MSMEs can onboard the digital ecosystem immediately.

“To accelerate literacy, we give education, we build what we call UMKM MU campus where all MSMEs in Indonesia cooperate with start-ups. And extraordinarily, the number has reached 2,100, so we have quite strong organs to educate all people of Indonesia,” he said.

To support digital financial literacy, the OJK is currently writing a book on fintech and a module of digital financial literacy program with the topic of p2p lending. The writing process is carried out in cooperation with Asian Development Bank and the World Bank. (MAY/UN) (DH/LW)