Government to Use Debts on Productive Activities

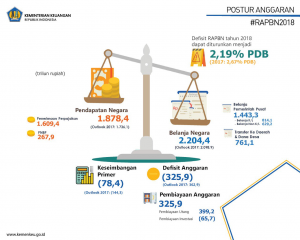

The State Budget in the Bill on the State Budget for the 2018 Fiscal Year and its Financial Note delivered by President Joko Jokowi Widodo before the Plenary Session of the House of Representatives of the Republic of Indonesia is projected to reach Rp1,878,447.3 trillion, consisting of Rp1,609.383.3 trillion of Tax Revenues, Rp267,867.1 trillion of Non-Tax State Revenues, and Rp1,196.9 of grants.

In the meantime, State Expenditures in the 2018 Bill on the State Budget are projected to reach Rp2,204,383.9 trillion, comprising of the Central Government Expenditures amounting to Rp1,443,296.4 trillion and the allocation for the Transfer to Regions and Village Fund amounting to Rp761,087.5 trillion.

With the aforementioned planned State Revenues and State Expenditures for 2018, the budget deficit in the 2018 Bill on the State Budget is projected to reach Rp325,936.6 trillion which will be closed with domestic and international sources of financing, in the form of loans/debts, the Financial Note says.

President Jokowi also asserted that the financial guidelines of the 2018 Bill on the State Budget are; (1) prudential, as to maintain debt ratio to the GDP stability; (2) efficiency, as to maintain the low debt revenue ratio to outstanding debt; and (3) productive, in which the debt will be utilized for productive activities that support acceleration of infrastructure development, including the development of Trans Sumatera, Trans Jawa, and MRT Jakarta.

The Financial Note also states that there are several challenges in the State Revenues, including (1) the tax revenue basis are still concentrated on a limited tax basis; (2) governance, competency, databases, access to domestic and international information that need to be improved; (2) low commodity prices; and (4) oil and gas lifting was not optimally implemented so it affected the achievement of revenue targets, particularly on oil and gas sector.

Regarding expenditures, the Government is still encountering several challenges, in which the Government continues to enhancing its quality, both for the utilization to productive activities in targeted and efficient manners and for the acceleration and improvement of quality of budget absorption while maintaining the quality of output.

In managing budget allocation for the Transfers to the Regions and the Village Fund, the Government stated that there are also several challenges, among others: (1) even though the budget for the Transfers to the Regions and the Village Fund has significantly increased and contributed to the improvement in public services in regions, it has not been able to optimally reduce the level of public service gap between regions; (2) most of the transfer funds to the regions cannot be utilized optimally by the regions and it turned into unused funds (SILPA) in the Regional Budget; (3) the Village Fund distribution formulation is still based on equity and does not reflect the aspect of justice; and (4) monitoring and evaluation mechanism to the implementation of Village Budget which has not been carried on optimally is still a challenge in the implementation of the Village Budget policy, so it needs a more intensive coordination with the related institutions.

Meanwhile, the Government still encounters with several challenges in budget financing management, among others: (1) to increase productivity of financing utilization sourced from debt primarily in supporting investment financing and productive activities; (2) to maintain the balance of sources of financing in the context of risk mitigation while maintaining macroeconomic balance; (3) to encourage efficiency in the procurement of debt, among others, through the efficiency of debt costs; (4) to control risk by keeping the prudent aspects of debt management; and (5) to encourage the development of innovative and creative financing in order to accelerate the achievement of development targets by empowering the role of private sector, State-Owned Enterprises (SOEs), and Regional-Owned Enterprises (ROEs). (ES)(RA/EP/YM/Naster)