Gov’t Braces for Economic Slowdown Due to Large-Scale Social Restrictions

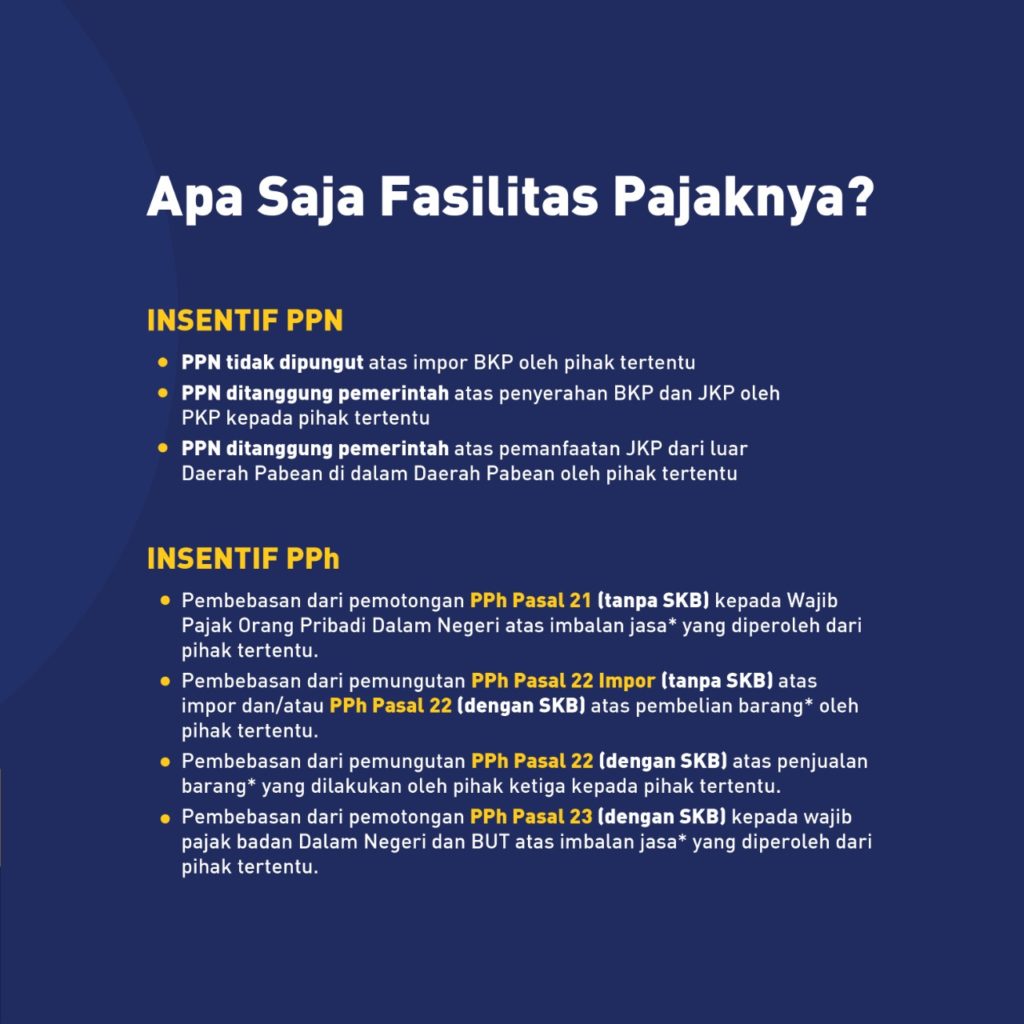

Incentives on Tax Facility

The Government is preparing steps to anticipate economic slowdown following the implementation of large-scale social restrictions (PSBB) in various regions.

According to Minister of Finance Sri Mulyani, the restrictions order has pushed the community and business sectors to the edge as their income has drastically dropped, forcing them to even shut their business for an uncertain period of time.

The Minister also explained that the Government must take measures to prevent deeper impacts on the national economy, one of them is by providing tax incentives for both individuals and companies.

Sri Mulyani pointed out that the state revenue from tax has dropped significantly. For example, personal income tax growth this year is recorded at only 4.94%, far below last year’s growth which recorded at 14.7%, she added.

The import and business entities income tax have also dropped due to the decline on import and economic activities, the Minister added.

Domestic value-added tax (VAT), which serves as the biggest contributor for the state revenue, has reported a slight increase by 10.2% for January-February period.

However, the figure may decline in the following period caused by decline in the public economic activities starting March, she added.

The former World Bank managing director noted that import VAT has also reported a decline of -8.7% or Rp37 trillion.

Economic pressure in various sectors has given an initial warning for the Government to review the financial health of companies.

Sri Mulyani further said that the Government will then review sectors mostly affected by the restrictions and will provide with several tax incentives accordingly. (MAY/EN)

Translated by: Estu Widyamurti

Reviewed by: M. Ersan Pamungkas