Gov’t Extends Tax Incentives, Strengthens Worker Protection

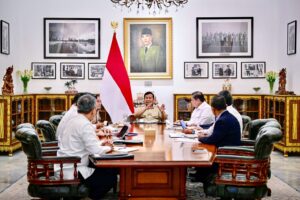

President Prabowo Subianto chairs a limited meeting with relevant Cabinet Ministers at the Merdeka Palace, Jakarta, Monday (09/15). (Photo by: BPMI of Presidential Secretariat)

President Prabowo Subianto Monday (09/15) chaired a limited meeting at the Merdeka Palace, Jakarta, with relevant Cabinet Ministers to discuss the continuation of the fiscal policy package and incentives for micro, small, and medium enterprises (MSMEs), tourism, labor-intensive industries, and the expansion of worker protection programs.

According to Coordinating Minister for Economic Affairs Airlangga Hartarto, the Government has provided long-term certainty for various incentives, including the continuation of the final income tax (PPh) policy for MSMEs with annual revenues of up to Rp4.8 billion with the 0.5 percent tax rate extended until 2029.

“So, we are not extending it year by year, but providing certainty until 2029. In 2025, the allocation has reached Rp2 trillion with 542,000 registered taxpayers, according to data from Ministry of Finance. In addition, a revision of the Government Regulation will be required,” the Minister explained.

In addition to MSMEs, he said, the Government is continuing the Government-Paid Income Tax (PPh Article 21) incentive for workers in the tourism sector, including hotels, restaurants, and cafes (horeka), which applies to employees earning below Rp10 million and carries an estimated budget of Rp480 billion.

“The extension of the Government-Paid Income Tax (PPh Article 21 DTP) for workers in the horeka sector, which was recently introduced, will continue next year. Taxes in the horeka sector remain covered by the Government until then,” he said.

Airlangga also stated that the Article 21 Income Tax (PPh) incentive will also continue for labor-intensive industries such as footwear, textiles, apparel, furniture, leather, and leather goods.

“The program targets 1.7 million workers, with an allocation of Rp800 billion this year, and will be extended into next year,” he added.

The meeting also discussed expanding contribution discounts for work accident and life insurance for non-wage workers. While this program initially covered online and offline motorcycle taxi drivers as well as related workers, it has now been broadened to include farmers, traders, fishermen, construction workers, and domestic workers.

“The target is 9.9 million workers with an estimated budget of Rp753 billion,” he said.

These policies highlight the Government’s unwavering commitment to pro-people measures by maintaining public purchasing power, ensuring fiscal certainty for MSMEs, and safeguarding workers across sectors amid global economic dynamics. (BPMI of Presidential Secretariat) (RIF/MUR)