Gov’t Issues Regulation on Tax Facilities during COVID-19 Pandemic

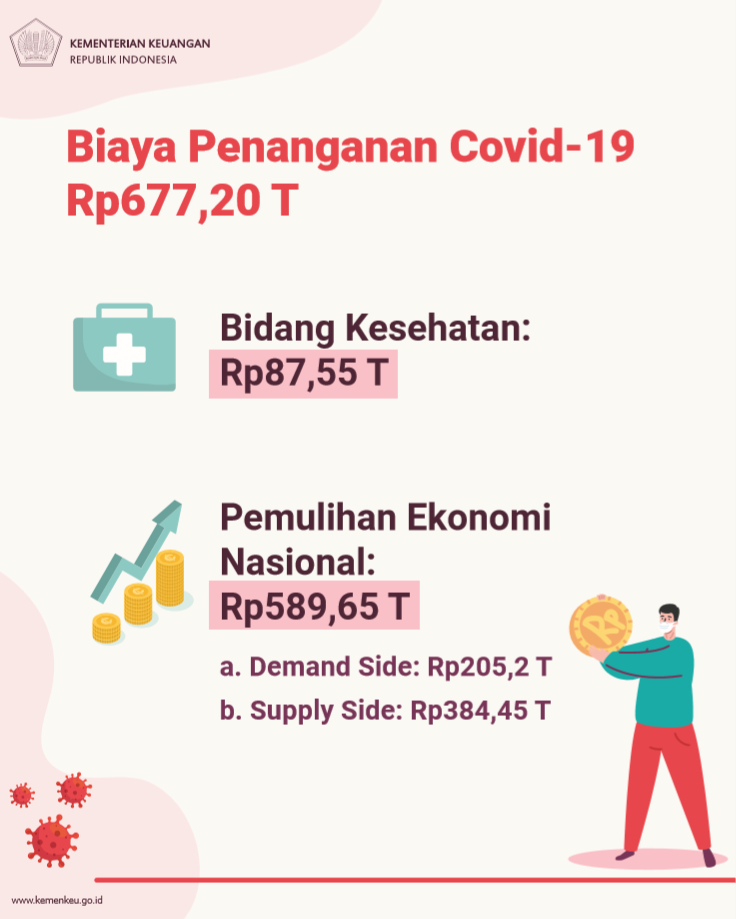

Budget to fund the handling of COVID-19 and the National Economy Recovery Budget. (Photo by: Ministry of Finance).

In a bid to provide certainty to tax and fiscal during COVID-19 pandemic, the Government has issued Government Regulation Number 29 of 2020 on Income Tax Facilities to Address Corona Virus Disease (Covid-19).

The statement was made by Taxation Regulation Director II Yunirwansyah in a virtual Media Briefing on Taxation on Thursday (25/6), in Jakarta.

Taxpayers who support the Government’s efforts in tackling COVID-19 pandemic are eligible for income tax facilities.

Based on the Regulation, the Government provides 5 tax facilities; among others:

First, Indonesian Resident Taxpayers (WPDN) who produce medical equipment and/or Household Health Supplies (PKRT) to handle COVID-19 are entitled to an additional reduction in net income by 30 percent of the costs incurred.

The medical equipment includes of N95 surgical masks and respirators, body protection, medical disposable ventilators, and diagnostic test reagents for Covid-19. Meanwhile the PKRT may include antiseptic hand sanitizers and disinfectants.

Second, for taxpayers who give donations to address COVID-19, the donations can be deducted from gross income. These donations must be supported by the receipt of donations and received by charitable institutions that have Taxpayer Identification Numbers (NPWP) such as National Disaster Management Agency (BNPB), Regional Disaster Management Agency (BPBD), Ministry of Health, Ministry of Social Affairs, or charitable institutions. However, the deduction must either follow provisions of Government Regulation Number 29/2020 or Number 93/2010.

In Government Regulation Number 29 of 2020, the donations may be given to the BNPB, BPBD, Ministry of Health, Ministry of Social Affairs, or charitable institutions that have the NPWP. The charitable institutions are obliged to report the donations. In this regard, donations may be given in the form of money, goods, and others. Donations that have been deducted as a reduction in gross income under Government Regulation No. 93 of 2010, cannot be further reduced under Government Regulation Number 93/2010. The taxpayers must choose between Government Regulation Number 29 or Number 93,” he said.

Third, the Regulation also states that individual taxpayers that are health workers and assigned to provide health services to address Covid-19 will receive additional income from the Government in the form of honoraria or other benefits.The additional income is subject to final Article 21 Income Tax withholding at a rate of 0 percent.

The health workers consist of medical staff and health support staff including cleaners, administrative staff, morticians, ambulance drivers, and other supporting staff.

Fourth, income of taxpayers in the form of the Government’s compensation and reimbursement for the use of assets based on Government Regulation Number 34 of 2017 is subject to a final income tax of 0 percent.

Fifth, taxpayers of publicly-listed company who are willing to buyback shares traded on the stock exchange are entitled to a 3 percent lower rate. Thus, 40 percent of their shares will be traded on the Indonesian Stock Exchange (BEI) or owned by at least 300 parties. Each party may only own shares of less than 5 percent of the total issued and fully paid shares within a minimum of 183 calendar days within a tax year. The parties do not include publicly-listed company taxpayers that repurchase their shares and/or are affiliated.

The taxpayers are considered meeting these requirements once they received appointment and approval from the Ministry/ Financial Services Authority (OJK). The share buyback is carried out from 1 March until 30 September 2020. The share can only be owned until 30 September 2020. They are obliged to submit report of share buyback in their Annual Tax Returns (SPT). (Ministry of Finance/EN)

Translated by : Rany Anjany

Reviewed by: Yuyu Mulyani