Gov’t to Boost Synergy to Eradicate Money Laundering, Terrorism Financing

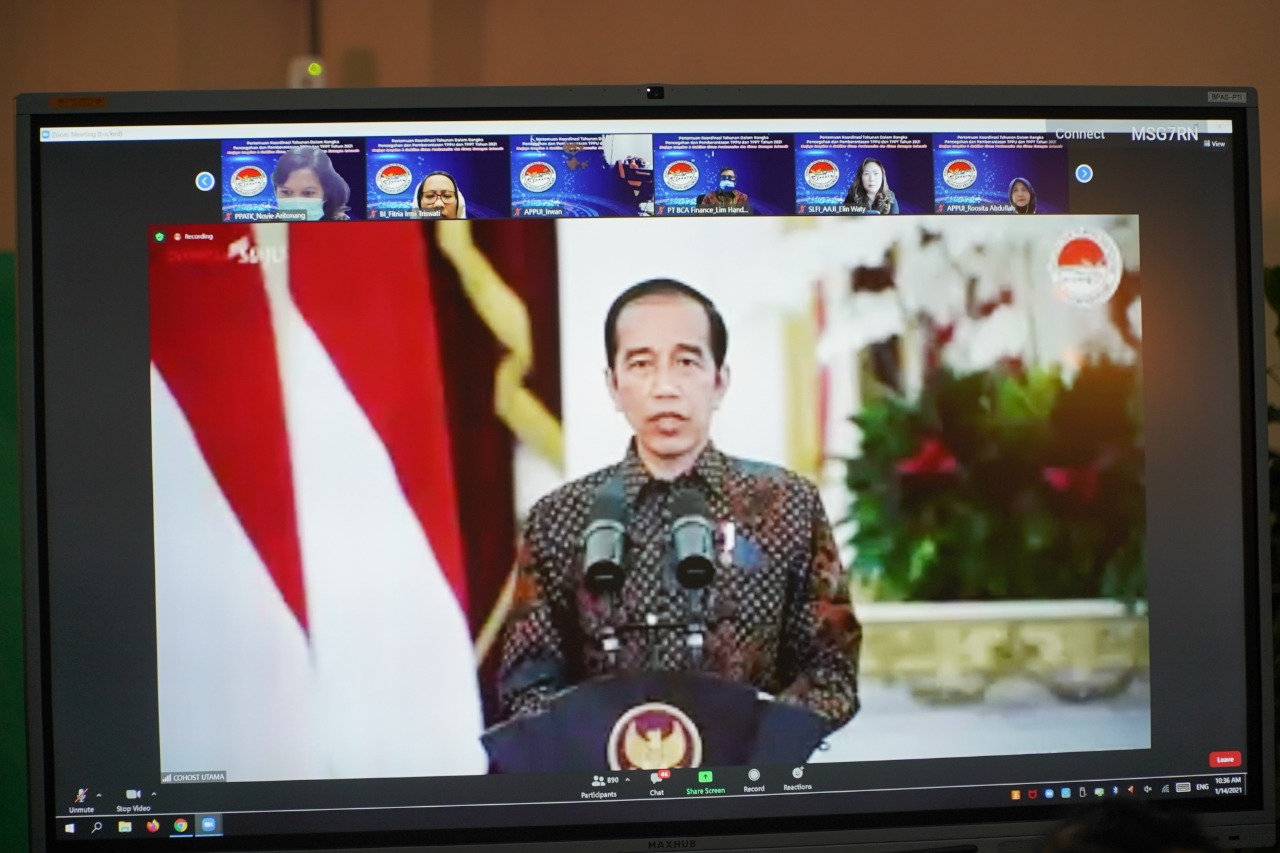

Annual Coordination Meeting for Countermeasure and Eradication of Crimes of Money Laundering and Terrorism Financing, Thursday (14/01/2021) virtually. (Photo by: ekon.go.id)

President Joko “Jokowi” Widodo has announced he fully supports the strengthening and optimization of the anti-money laundering and counter-terrorism financing (AML-CFT) regime through strategic policies that make it easier for all stakeholders.

According to the President, the move can be materialized by establishing various regulations in the countermeasure and eradication of the crimes of money laundering and terrorism financing.

Law Number 8 of 2010 on the Countermeasure and Eradication of the Crime of Money Laundering (TPPU) has mandated the establishment the TPPU Committee with the task of coordinating the handling of countermeasure and eradication of the crimes of money laundering, including terrorism financing (TPPT).

The TPPU Committee comprises Heads of 16 (sixteen) ministries and institutions including Coordinating Minister for Political, Legal and Security Affairs and Coordinating Minister for Economic Affairs as Chair and Deputy Chair of the TPPU Committee, and assisted by Head of the Financial Transaction Reports and Analysis Center (PPATK) as Secretary of the TPPU Committee.

The TPPU Committee also plays a role in maintaining integrity and stability of the country’s economic system and financial system. Taking into account the more increased variety of economic crimes that exploit or abuse the financial services sector to hide or disguise the proceeds of crime, particularly corruption, it will pose a threat to the integrity and stability of the economic and financial systems in the country.

The main output of the TPPU Committee is the establishment of a National Strategy for the Countermeasure and Eradication of Money Laundering and Terrorism Funding Crimes (Stranas TPPU and TPPT). Within the course of 2012-2020, the TPPU Committee has established 3 (three) Stranas TPPU and TPPT.

Meanwhile, the 2020-2024 National Strategy focuses on 5 (five) aspects, as follows: improved ability of private sectors to detect indications or potential of money laundering, terrorism financing and funding for the proliferation of weapons of mass destruction by taking into account risk assessments; increased efforts to prevent money laundering and terrorism financing by taking into account risk assessment; greater effectiveness of eradication of money laundering and terrorism financing by taking into account risk assessments; optimizing asset recovery by taking into account risk assessments; and greater effectiveness of targeted financial sanctions in disrupting terrorist activities, terrorists, terrorist organizations, and proliferation of weapons of mass destruction.

In the meantime, Coordinating Minister for Economic Affars Airlangga Hartarto pointed out that the 2021 Annual Coordination Meeting for the Countermeasure and Eradication of TPPU and TPPT is of strategic importance, considering that Indonesia is currently still facing COVID-19 pandemic and is running the National Economic Recovery Program (PEN), which requires seriousness and enormous costs, as well as contributions from all components of the nation.

The Coordinating Minister went on to say that the TPPU (according to a report of the Financial Action Task Force/FATF) can occur in different variants, involving counterfeiting medical goods, cybercrime, investment fraud, charity fraud, and abuse of economic stimulus measures.

“The completion of mutual evaluation process in the context of Indonesia’s full membership in the FATF as well as efforts to build a system to prevent irregularities in various sectors becomes our common concern,” he said.

The FATF also highlighted a host of issues, namely changes in the habits of public financial transactions through the internet (online) due to restrictions on social movements, closure of bank and company offices; and increased financial volatility and economic contraction, mainly due to the loss of millions of jobs, the closure of thousands of companies, and global economic crisis and recession.

Regarding the risk mitigation of money laundering and terrorism financing caused by COVID-19, the Government, he said, has appealed to the Supervisory and Regulatory Agency (LPP), which is related to AML-CFT, to strengthen the implementation of risk-based supervision, as required in the international standards contained in FATF’s 40 Recommendations..

Airlangga also asked for support from the President for the stipulation of 2 (two) bills that could strengthen the AML-CFT regime, namely the bill on Limiting Currency Transactions and the bill on Confiscation of Criminal Assets, so it could become a priority bill this year.

It is hoped that in the future, the TPPU Committee can play a role in efforts to rebuild national economy by supervising and monitoring the national economic recovery (PEN) program, he added.

The TPPU Committee has also involved the private sector through the establishment of the Indonesian Transaction Report and Analysis Center Network (Intracnet) at the end of 2020 which is expected to further optimize the AML-CFT regime in maintaining the integrity and stability of economic and financial system in Indonesia. (Coordinating Ministry for Economic Affairs PR/UN) (MUR/EP)