Gov’t to Charge VAT on e-Commerce Purchases Starting 1 July 2020

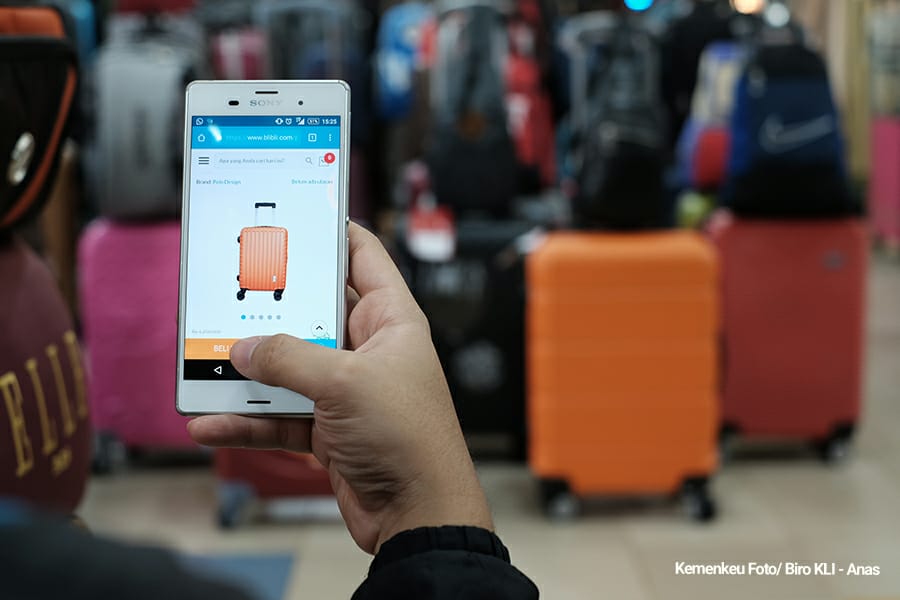

Illustration of e-commerce. (Photo by: Ministry of Finance)

The Indonesian Government has announced that starting 1 July 2020, it will collect 10% of Value Added Tax (VAT) for purchases of digital products and services from traders or providers of Trade Through Electronic Systems (PMSE).

The tax applies to both foreign and domestic trades, which reach certain transaction value or a certain amount of traffic and access within 12 months.

This policy is part of the Government’s efforts to create fairness and level playing field for all business people, both domestic and foreign, both conventional and digital.

In addition, this policy is carried out to implement Article 6 paragraph 13a of Government Regulation in Lieu of Law (Perppu) Number 1 of 2020 on State Financial Policy and Financial System Stability for COVID-19 Handling, where the Government stipulates Minister of Finance Regulation Number 48/PMK.03/2020 as its derivative.

Under this regulation, digital products such as music and film streaming services, digital applications and games, and other online services from abroad that have significant economic presence and have taken economic benefits from Indonesia through their trade transactions, will be treated equally as conventional products or similar digital products from within the country.

The VAT policy implementation is also expected to boost state revenue to cope with the impact of the COVID-19 pandemic and maintain the credibility of the State Budget and the stability of the country’s economy in times of the current global crisis.

Through taxes, the Government said it invites all parties to cooperate and to take roles to overcome the challenges posed by COVID-19. (Ministry of Finance/EN)

Translated by: Fairuzzamani Inayatillah

Reviewed by: M. Ersan Pamungkas