Gov’t to Provide Additional Working Capital for MSMEs

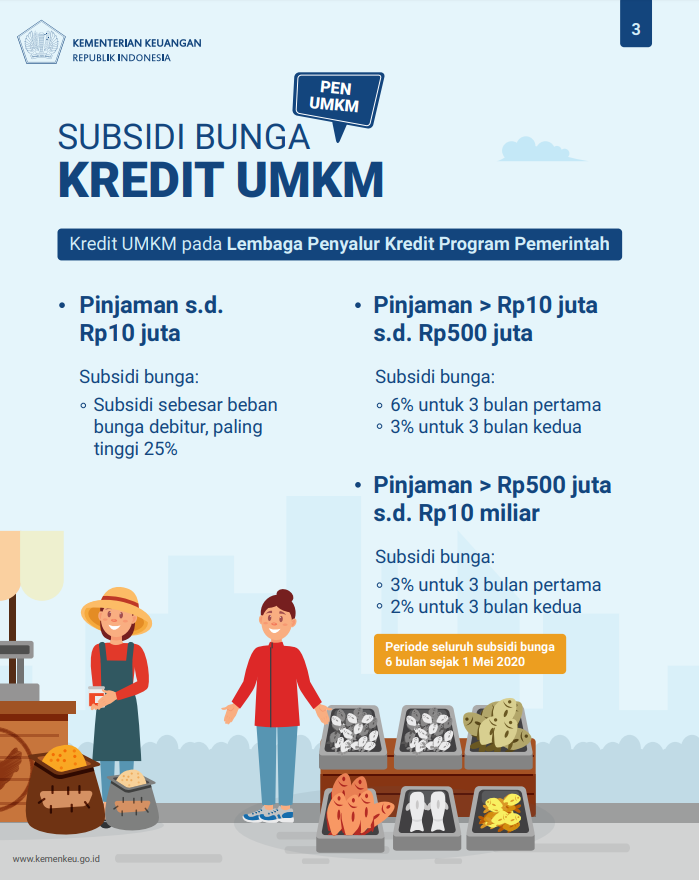

Infographics on Credit Interest Subsidies for Micro, Small, and Medium Enterprises (MSMEs). (Source: Ministry of Finance)

The Government has announced that it will provide additional new working capital loans to revive the country’s economy through the National Economic Recovery Program (PEN), according to Minister of Finance Sri Mulyani Indrawati.

The Minister made the statement during the launching of working capital loan guarantees for Micro, Small, and Medium Enterprises (MSMEs) in the National Economic Recovery Program through video conference, Tuesday (7/7).

“The PEN program aims to protect and recover the country’s economy due to the negative impacts of COVID-19 pandemic,” Sri said, adding that a total budget worth Rp123.46 trillion is expected to increase money circulation and help the MSMEs.

The Government has regulated working capital loan guarantees scheme for MSMEs through Finance Ministry Regulation (PMK) Number 71/2020, which assigned state-owned credit insurer Jaminan Kredit Indonesia (Jamkrindo) and state-owned insurer Asuransi Kredit Indonesia (Askrindo) to provide guarantees for banks to channel loans to MSMEs.

In addition to providing working capital loans, the Government will also allocate Rp6 trillion to Jamkrindo and Askrindo through Guarantee Services (IJP) spending, loss limits, and state capital injections (PMN).

MSMEs that carry out loan restructuring can postpone principal loan payment for six months and receive full interest subsidies if they have smaller loans.

Debtors with capital loans up to Rp10 billion will be given a smaller amount of interest subsidy, starting a 2% to 3% interest subsidy.

MSMEs can also receive guaranteed new working capital loans with the tax borne out by the Government.

“This stimulus is the complete menu from the Government to revive our MSMEs so that they can return to their activities, to be productive and safe amid COVID-19 pandemic, as well as can move our economy, especially those who are at the grassroots level,” Sri said.

Furthermore, Sri stated that aside from more than 60 million MSME actors under the banking institutions that will be helped through the program, the Government, she added, will also support the MSMEs under the funding institutions.

“We also cover MSMEs in Pegadaian (state pawnshop), in the Mekaar (which stands for Membina Ekonomi Keluarga Sejahtera/ Fostering the Economy of the Prosperous Family) from state-owned community development institution PT Permodalan Nasional Madani (PNM), or those in ultra-micro, cooperatives, and even waqf (Islamic endowment) banks. The Government has given all the allocation of resources, supported MSMEs with policies, provided loan guarantees, and provided cheaper fund sources to revive the country’s economy,” Sri concluded. (Ministry of Finance / EN)

Translated by: Syarifah Aisyah

Reviewed by: Yuyu Mulyani