Gov’t to Provide Tax Incentives for Eligible Business Groups Amid COVID-19

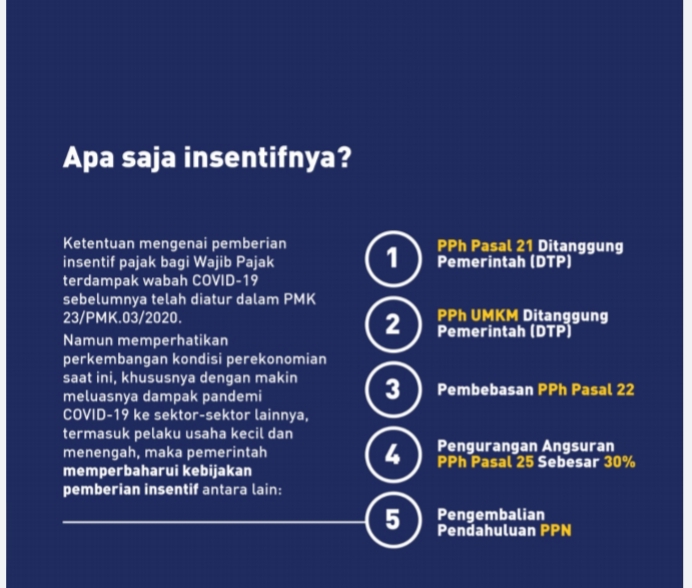

Infographic of Tax Incentives. (Source: Ministry of Finance).

Thousands of business groups that are considered eligible to receive support will receive tax incentives amounting to Rp123.01 trillion, Minister of Finance Sri Mulyani has announced.

“Tax incentive is a form of support to the business sector as one of sectors most affected by the COVID-19 pandemic,” Sri Mulyani said, Wednesday (3/6).

The tax incentives, the Minister continued, is expected to provide assistance for them to survive these tough times.

“So in addition to providing working capital loans, especially for small interest subsidies, and debt restructuring, the Government also provides assistance for them in the form of tax incentives to ease the burden of the business sector as much as possible,” the Minister said, adding that based on Article 21 on Employee Tax, more than 1,062 industry groups or sectors are listed as tax incentive recipients.

“Those 1,062 business groups ranging from industry to service, trade, transportation, and health sectors and other sectors are included to enjoy the tax incentive. The total budget for this groups reaches Rp25.6 trillion,” Sri Mulyani said.

For MSMEs, she added, the taxes are also paid by the Government so that they will not pay taxes for a final tax of 0.5%.

“431 business groups that import raw materials, especially manufacturing industries, are also exempt from import tax article 22 which amount to Rp14.75 trillion,” the Minister said, adding that the companies first should pay their VA, then the Government will give a refund in advance which amounting to Rp5.8 trillion in total.

Sri Mulyani went on to say that for corporations, Article 25 on Income Tax is cut by 30%.

“The incentives are given for 846 business groups, from manufacturing sector to service sector. The total amount of the incentives reaches Rp14.4 trillion, ” she said.

Sri Mulyani also pointed out that based on laws and regulations, the Government has also cut the corporation tax rate by 3% to only 22% from originally 25%.

“This will certainly bring a more positive impact on the company to help them survive,” she said. (TGH / EN)

Translated by: Estu Widyamurti

Reviewed by: M. Ersan Pamungkas