Gov’t to Provide Two Protection Programs for MSMEs

Micro, Small, and Medium Enterprises (MSME) Protection Scheme

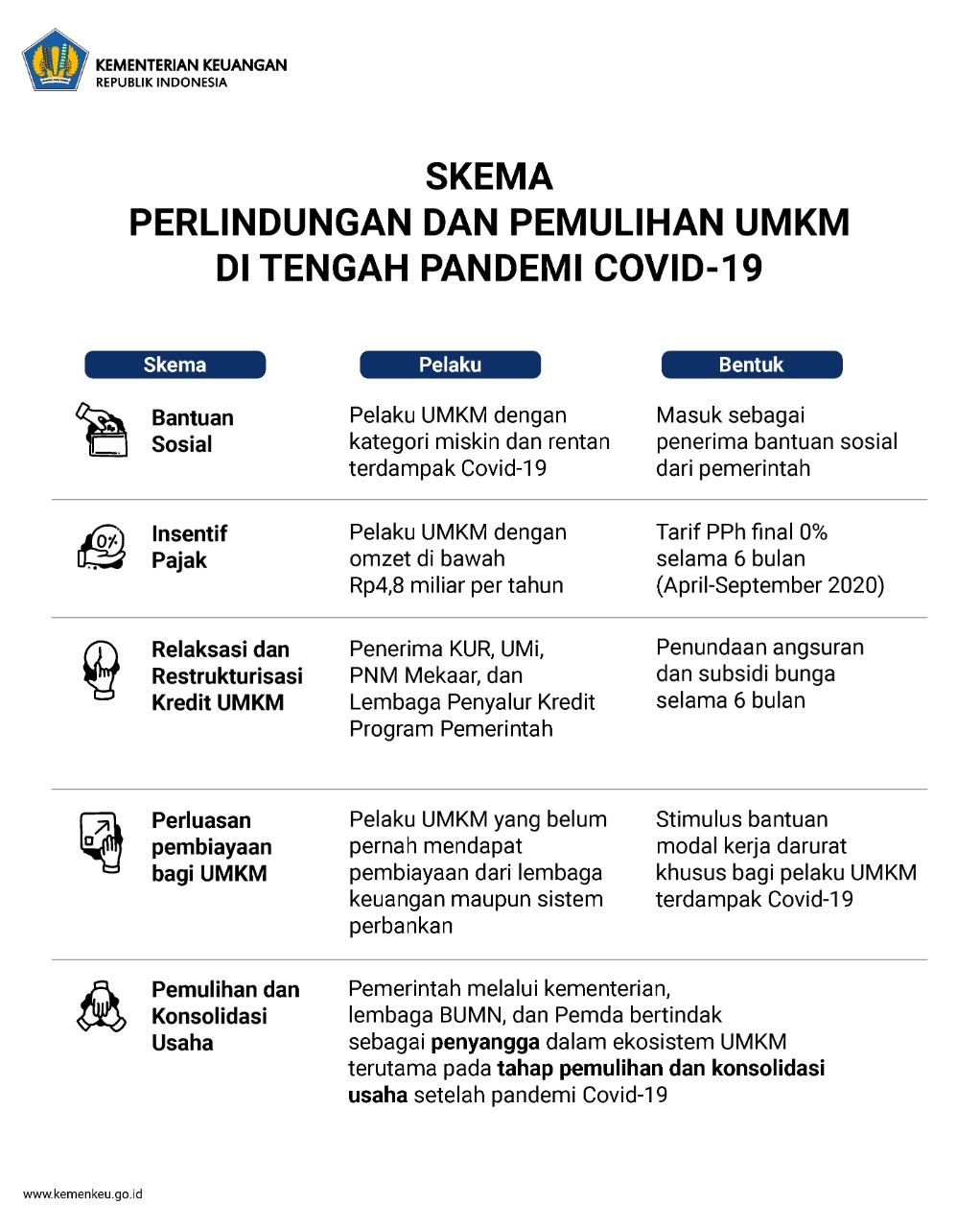

In a bid to protect businesses of Micro, Small, and Medium Enterprises (MSME), the Government will provide interest subsidies and placement of funds program.

“All schemes of economic recovery programs will be included in the amendment to Presidential Regulation on the State Budget posture, including interest subsidies for MSMEs worth Rp35.28 trillion,” Minister of Finance Sri Mulyani Indrawati stated during a press conference after a Limited Cabinet Meeting, Wednesday (3/6).

According to the Minister, the programs will be implemented in all financial institutions under the supervision of the Financial Services Authority (OJK), including rural banks (Bank Perkreditan Rakyat), conventional and Islamic microcredit banks, financing companies, as well as people’s business credit that will be channeled through banks and non-banks such as the Public Service Agency (BLU) and State-Owned Enterprises (BUMN).

” Mekaar (Fostering the Economy of the Prosperous Family) program that is supported by microfinancing company PT Permodalan Nasional Madani (PNM) in collaboration with state-owned pawnshop PT Pegadaian , ultra-micro enterprises that is supported by the Government Investment Center (PIP) and farmer cooperatives, and other MSMEs fostered by Regional Governments are included in this interest subsidies program,” the Minister said.

The Minister went on to say that the subsidy assistance amounted to Rp35.28 trillion, which will cover more than 60 million accounts. The total postponement of principal installment amounting to Rp285 trillion for outstanding loans worth Rp1,601 trillion.

Aside from six months postponement of credit payments for MSMEs, she added, the economic recovery program will also provide placement of funds to stimulate financial institutions and banks to give loans to MSMEs. This aims to help MSMEs to survive this COVID-19 crisis and to help them to get new working capital loans to improve their business operations.

For the record, Ministry of Finance and the Financial Services Authority (OJK) have issued a joint decree on the implementation of the two programs, i.e. interest subsidies for MSMEs and placement of funds for restructuring and a program to provide working capital loans by giving credit risk guarantee.

“Therefore, we also asked state-owned credit insurer Jamkrindo and credit insurance firm Askrindo to be able to provide guarantees for working capital loans provided by banking institutions to MSMEs under Rp10 billion, which premiums for guarantee services, counter guarantees, and loss limits will be borne by the Government as sharing risks so that financial and banking institutions will recover and return to provide working capital loans for MSMEs,” Sri said.

For the provision of working capital credit guarantees, Sri said that the Government will support through the PMN to Jamkrindo-Askrindo amounted to Rp6 trillion plus fee for guarantee services amounting to Rp5 trillion, and guarantee reserves for stop loss amounting to Rp1 trillion.

“The Government will provide guarantee reserves for stop loss worth Rp12 trillion to help MSMEs get working capital loans up to Rp 10 billion,” Sri added.

The program, the Minister added, is expected to cover the demand of working capital loans that reach Rp150 trillion to drive the economy, especially at MSMEs level.

The Minister also said that Ministry of Finance will use the joint decree with the Financial Services Authority (OJK) to implement the placement of funds for restructuring.

“We have discussed the program’s mechanism. The implementation will be carried out immediately once the schemes established,” the Minister said. (TGH / EN)

Translated by: Syarifah Aisyah

Reviewed by: Mia Medyana