Industries Hope to Improve Labors Skills with Tax Deduction

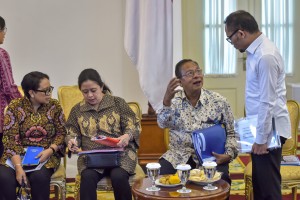

Coordinating Minister for the Economy Darmin Nasution engages in conversation with Minister of Manpower Hanif Dhakiri before a plenary cabinet meeting, at the Bogor Presidential Palace, West Java, Monday (8/7). (Photo by: Agung/PR)

200% tax deduction granted to businesses and industries which provide vocational programs as regulated in Government Regulation Number 45 of 2019 is expected to improve quality of human resources, according to Coordinating Minister for the Economy Darmin Nasution.

The tax deduction will be granted to businesspersons or employers who provide workplace learning and training that can promote their roles in improving skills and knowledge of the workers, Darmin said on Tuesday (9/7).

For the record, President Joko Jokowi Widodo on 25 June 2019 signed Government Regulation Number 45 of 2019 on the Amendment to Government Regulation Number 94 of 2010 on Calculation of Taxable Income and Repayment of Income Taxes in the Current Year.

Article 29A of this regulation states that for domestic taxpayers who make new investments or business expansion in certain business sectors that constitute: a. a labor intensive industry; and b. do not obtain facilities as referred to in Article 31A of the Income Tax Law or facilities as referred to in Article 29 paragraph (1), income tax facilities may be given in the form of 60% net income deduction of the total investment in the form of tangible fixed assets including land used for main business activities, which are charged for a certain period of time.

Meanwhile, Article 29B states that for domestic taxpayers who organize working programs, internship and/or education aimed at fostering and developing certain competency-based human resources may be given a deduction in gross income of no more than 200% (two hundred percent) of the total costs incurred.

For domestic corporate taxpayers who conduct certain research and development (R&D) in Indonesia, according to this Government Regulation, a deduction in gross income may be given of no more than 300% (three hundred percent) of the total costs incurred which are charged in a certain period of time.

Darmin expressed hope that the Government Regulation can encourage business sector to play a greater role in improving quality and competitiveness of Indonesian human resources which will be in line with the needs of business sector and industries.

The incentives of major tax deduction for vocational programs, he added, means an income tax facility in form of a deduction in gross income of no more than 200 percent of the total costs incurred.

The subject to this regulation is domestic taxpayers who provide vocational programs, such as working programs, internship and/or education aimed at fostering, and developing certain competency-based human resources.

Certain competencies in the incentives are competencies needed by business and industrial sectors, Darmin added.

The Minister added that the amount of tax deduction in this Government Regulation is equal to that of Thailand, namely 200 percent but the incentives cover more aspects than the one implemented in Thailand.

The incentives constitute tax deduction of no more than 200 percent of the training costs incurred in workplace learning and training, as well as exemption of import duty and Value Added Tax for equipment and machinery used for training programs.

The incentives also include deduction of electricity and water bills of no more than twofold of the total costs incurred on learning and training program.

This policy, which is aimed at providing more jobs and reducing unemployment rate – is the follow-up of coordination of Coordinating Ministry for the Economy with related ministries/agencies, particularly Ministry of Finance, Ministry of Industry, Ministry of Manpower, Ministry of Education and Culture, and Ministry of Research, Technology and Higher Education. (Coordinating Ministry for the Economy PR/ES)

Translated by : Rany Anjany Subachrum

Edited by : M. Ersan Pamungkas