OJK Issues New Regulations to Overcome COVID-19 Impacts

Image Source: the Financial Services Authority.

The Financial Services Authority (OJK) has issued five Regulations to implement the Government Regulation in Lieu of Law (Perppu) Number 1 of 2020.

The Regulations of the Financial Services Authority (POJK) aim to support measures to maintain financial system stability, and to support the national economy to overcome the impact of the COVID-19.

The Important points of the Regulations are as follows:

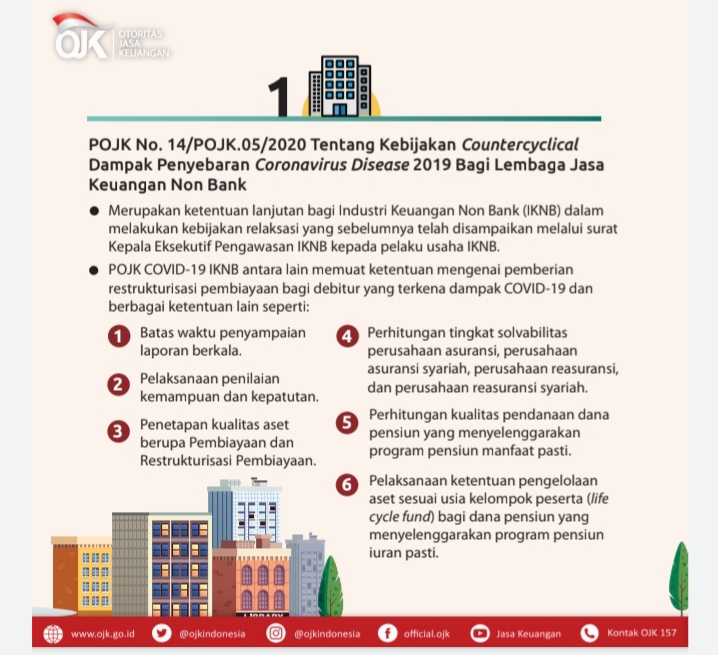

- Regulation of the Financial Services Authority Number 14/POJK.05/2020 on Countercyclical Policies on the Impact of Coronavirus Disease 2019 for Non-Bank Financial Services Institutions

The Regulation covers provisions for Non-Bank Financial Industry in conducting relaxation policies that have previously been issued through Circular of the Chief Executive of Non-Bank Financial Industry Supervision to Non-Bank Financial Industry institutions.

The Regulation stipulates, among others, provisions on financing restructuring for debtors affected by COVID-19 and the following other provisions:

- Deadline for submitting periodic reports;

- Procedures for fit and proper test;

- Determination of asset quality in the form of financing and financing restructuring;

- Review of the solvability level of insurance companies, sharia insurance companies, reinsurance companies, and sharia reinsurance companies;

- Review of the quality of pension funds financing that provides a guaranteed benefit pension plan;

- Implementation of asset management provisions in accordance with the age group of participants (life cycle fund) for pension funds that carry out fixed contribution pension plan.

- Regulation of the Financial Services Authority Number 15/POJK.04/2020 on Plan and Procedures for General Meeting of Shareholders of Public Companies

The Regulation is an amendment to Regulation of Financial Services Authority Number 32/POJK.04/2014 on Plan and Procedures for General Meeting of Shareholders of Public Companies.

The Regulation aims to increase shareholder participation in the General Meeting of Shareholders of the public company, especially in the form of attendance quorums. Shareholders can electronically authorize third party to represent them and to vote at the General Meeting of Shareholders.

The main points of the Regulation are as follows:

- Provisions regarding notification of agenda, announcement and invitation of the General Meeting of Shareholders;

- The obligation of the public company to provide an alternative electronic authority for shareholders to attend and vote at the General Meeting of Shareholders;

- Electronic authorization is carried out using the Electronic General Meeting of Shareholders System (e-GMS) provided by the e-GMS Provider or a system provided by the public company;

- Parties who can receive electronic authority include:

- Participants who administer the sub-account /securities of the shareholders;

- Parties provided by public companies; or

- Parties appointed by shareholders.

- Activities of e-GMS Providers can only be carried out by the Depository and Settlement Institution appointed by the Financial Services Authority or other parties approved by the Financial Services Authority.

- Regulation of the Financial Services Authority Number 16/POJK.04/2020 on the Procedures for Electronic General Meeting of Shareholders of Public Company

The Regulation stipulates the process of decision making in General Meeting of Shareholders of public company through teleconference, video conference, or other electronic facilities.

Public Company is allowed to hold an electronic General Meeting of Shareholders. In general, the implementation of the electronic General Meeting of Shareholders is as follows:

- Limited physical presence is required in General Meeting of Shareholders (at the minimum, General Meeting of Shareholders chairperson, one member of the board of directors and/or one member of the board of commissioners and supporting professional should attend the meeting);

- Shareholders are given the opportunity to be physically present, as long as the public company provides a certain quota (not for all shareholders);

- The electronic presence of shareholders at the General Meeting of Shareholders can replace the physical presence of shareholders and is counted as the attendance quorum;

- Under certain conditions, public company may not carry out physically-attended General Meeting of Shareholders or limit the physical presence of shareholders either partially or generally in an electronic General Meeting of Shareholders;

- The certain conditions are determined by the Government or with the approval of the Financial Services Authority.

- Regulation of the Financial Services Authority Number 17/POJK.04/2020 on Material Transactions and Changes in Business Activities

The Regulation aims to implement the mandate in Article 23 paragraph (1) letter b of Government Regulation in Lieu of Law Number 1 of 2020, and is an amendment to Regulation of the Capital Market and Financial Institution Supervisory Agency (Bapepam-LK) Number IX.E.2 on Material Transactions and Changes in Main Business Activities.

All provisions in the Regulation shall apply six months after its promulgation except for regulations that provide exempt for financial service institutions, under certain conditions, from the obligation to implement the principle of openness in the Capital Market sector in the event that the Regulation is enacted.

The main points of the Regulation are as follows:

- Expansion of the scope of the definition of Material Transactions that covers every transaction carried out by a public company or a controlled company that meets the value limits stipulated in the Regulation;

- Expansion of the limit on the Material Transaction value. In the event that the public company has negative equity then the calculation of the transaction value is equal to 10% or more of the total assets of the public company;

- Completion of the scope of the Material Transaction that includes:

- Material Transactions that disrupt business continuity;

- Restructuring transactions of State-Owned Enterprises;

- Transactions conducted by financial services institutions under certain conditions; and

- Dilution of material value;

- The Regulation stipulates that financial services institutions that conduct Material Transactions are exempted from the obligation to conduct disclosure of information to the public, but are still required to report to the Financial Services Authority.

- Regulation of the Financial Services Authority Number 18/POJK.03/2020 on Written Order for Handling Bank Problems

The Regulation stipulates that the Financial Services Authority shall take measures needed to maintain financial system stability, especially in the banking sector, amid the economic slowdown as a result of the spread of the COVID-19 pandemic.

The Regulation generally stipulates the followings:

- The scope of the Regulation applies to Banks, namely Conventional Commercial Banks (BUK), Sharia Commercial Banks (BUS), Credit Banks (BPR), Sharia Credit Banks (BPRS), and branch offices of Banks domiciled overseas;

- The Financial Services Authority is entitled to issue Written Order to Banks to:

- conducting merger, consolidation, acquisition, and/or integration; and/or

- accepting merger, consolidation, acquisition, and/or integration.

- Written Orders are given to Banks that meet the criteria based on the Financial Services Authority assessment;

- Bank that receives Written Orders is obliged to prepare action plan, and to carry out and maintain the smooth process of merger, consolidation, acquisition, and/or integration in accordance with the action plan;

- In implementing Written Orders to carry out or accept merger, consolidation, acquisition, and/or integration:

- There are some adjustments to the process of merger, consolidation, acquisition, and/or integration;

- Conventional Commercial Banks or Sharia Commercial Banks, based on the approval of the Financial Services Authority, may be exempted from the provisions regarding sole ownership in Indonesian banks, ownership of commercial bank shares, and/or deadline for fulfilling minimum core capital;

- For Credit Banks or Sharia Credit Banks, the office network can still be maintained in accordance with the office network area that has been established. (PR of the Financial Services Authority/EN)

Translated by: Ridwan Ibadurrohman

Reviewed by: Yuyu Mulyani