President Jokowi: Fintech Drives National Economic Growth

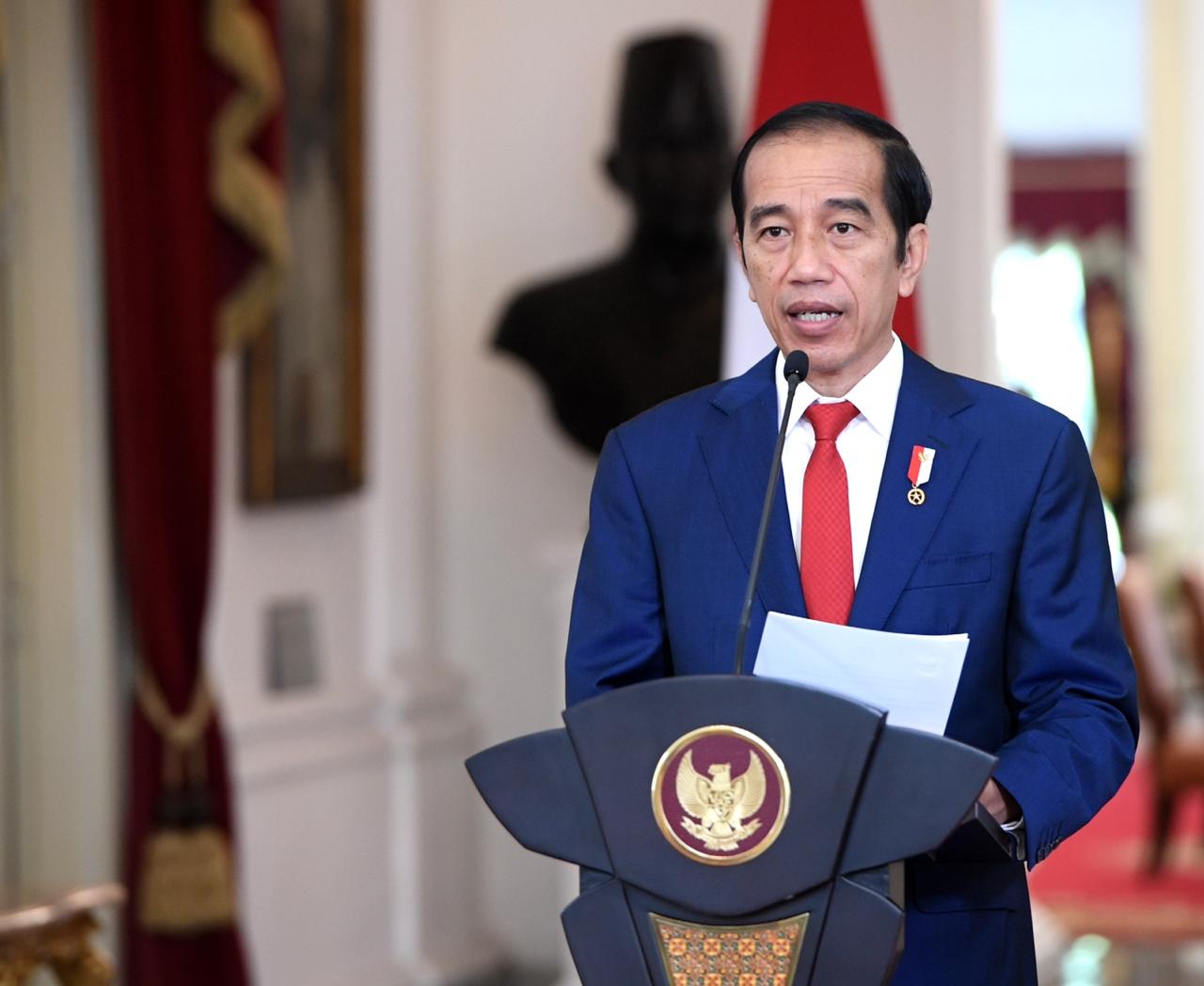

President Joko Widodo at the Opening of Indonesia Fintech Summit 2020 and Fintech Week 2020 virtually, Wednesday (11/11). (Photo: BPMI)

President Joko “Jokowi” Widodo expressed appreciation to the innovators and founders of the country’s financial technology industry as they have made a positive contribution to the national economy and increase the people’s access to financial services.

Data shows that in 2020 alone, the distribution of financing carried out by fintech industry has reached Rp128.7 trillion or increased by 113 percent from that in the previous year.

“As of September 2020, there are 89 fintech providers who have contributed as much as Rp9.87 trillion to Indonesian financial service transactions and Rp15.5 trillion was channeled by licensed fintech equity crowdfunding operators. This is an extraordinary development,” the President said at the Opening of the Indonesia Fintech Summit 2020 and Fintech Week 2020 virtually, Wednesday (11/11).

However, the President pointed out that there are still more works to do in developing the financial technology, adding that based on the Financial Inclusion Index, Indonesia is still lagging behind several ASEAN countries in this industry.

“In 2019, our Financial Inclusion Index is 76 percent. It is lower than that of some countries in ASEAN, for example Singapore which is at 98 percent, Malaysia at 85 percent, Thailand at 82 percent. Once again, we are still at 76 percent,” he said.

The President went on to say that the level of public literacy towards digital finance also remains very low as data shows that only about 35.5 percent of people know about digital finance, there are still many people who use informal financial services and only 31.26 percent of people have used digital services.

Therefore, the Head of State expressed hope that fintech providers will not only become lenders and providers of online payments, but also act as the main driver of digital financial literacy for the communities and expand digital marketing for MSMEs.

“Fintech providers must also develop themselves continuously to carry out the function of aggregator and innovative credit scoring by providing equity crowdfunding and project financing services,” he said.

Furthermore, President Jokowi also noted that technological developments in the financial sector could also pose potential risks, including cybercrimes, misinformation, error transactions, and misuse of personal data.

Moreover, he added, non-financial banking regulations are not as strict as banking regulations; thus, fintech industry players need to strengthen better governance and mitigate various risks that may arise.

“By doing so, I hope the fintech industry can provide safe services for the people and make a major contribution to the development of MSMEs and the national economy,” he said. (FID / BPMI / UN)

Translated by: Estu Widyamurti

Reviewed by: M. Ersan Pamungkas