President Prabowo and Team Discuss Strategic Policy on Foreign Exchange Export Proceeds

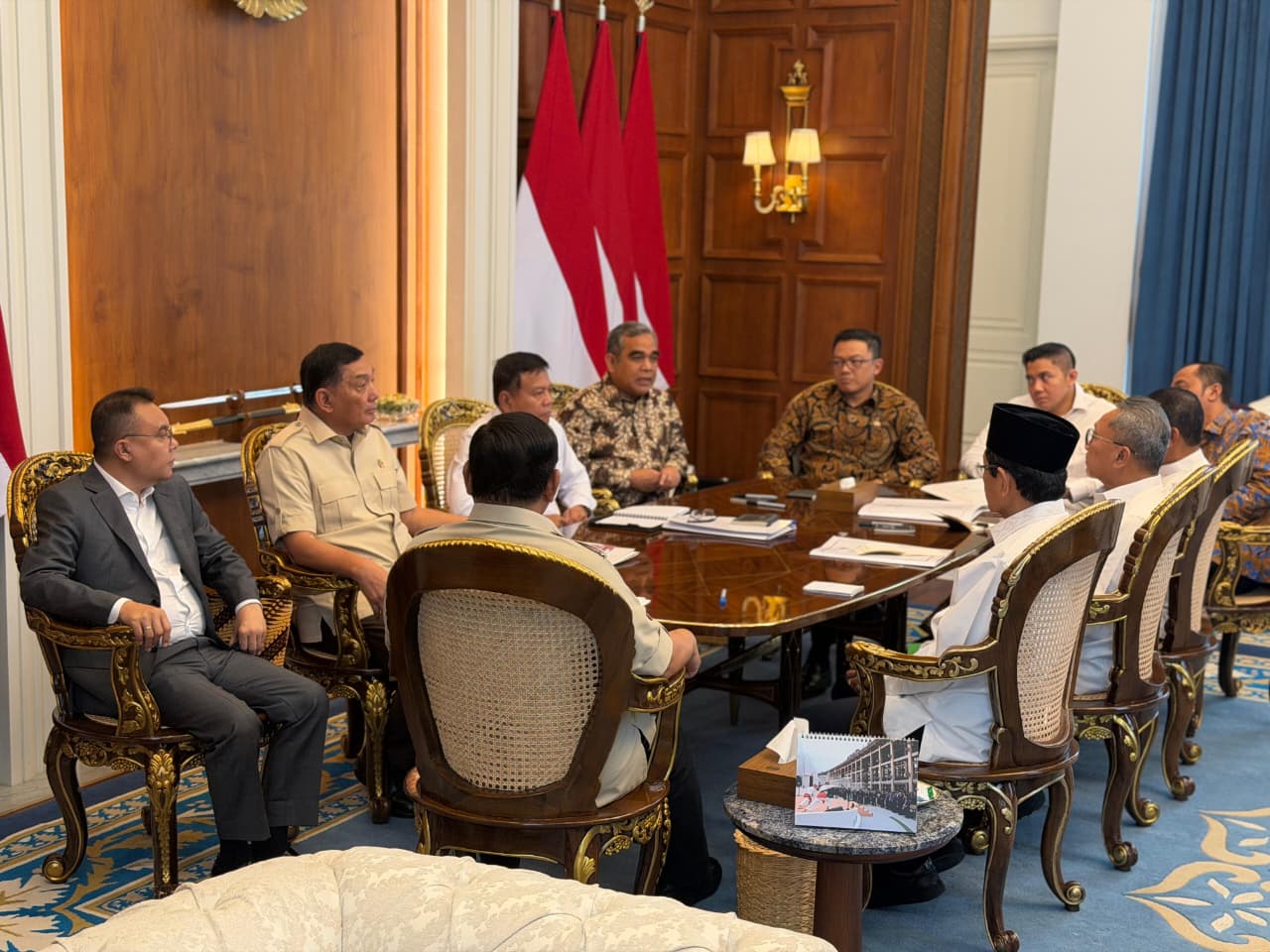

President Prabowo Subianto and his team held a limited cabinet meeting discussing policies related to foreign exchange export proceeds (DHE) at Merdeka Palace, Jakarta (01/21). (Source: BPMI of Presidential Secretariat)

President Prabowo Subianto and his team held a limited cabinet meeting (01/21), at the Merdeka Palace in Jakarta, discussing policies related to foreign exchange export proceeds (Devisa Hasil Ekspor – DHE). In a statement to the media, Coordinating Minister for Economic Affairs Airlangga Hartarto explained that the DHE policy will be applied comprehensively, requiring 100% compliance for a one-year period.

“The Government and central bank Bank Indonesia (BI) are preparing facilities, including a 0% income tax rate on interest income from instruments used for placing DHE. Normally, the tax rate is 20%, but for DHE, it will be 0%,” Airlangga stated.

The Coordinating Minister further elaborated on various mechanisms to assist exporters in utilizing DHE. Exporters can use DHE placement instruments as collateral for rupiah loans from banks or the Indonesia Investment Authority (INA).

“Exporters can utilize DHE placement instruments as back-to-back collateral for rupiah loans from banks or INA to meet their domestic rupiah needs,” he explained.

Airlangga added that DHE placement instruments used as collateral will be excluded from the maximum credit limit (BMPK). He emphasized that this provision will not affect the gearing ratio of companies.

“The provision of funds using placement instruments of natural resources’ export proceeds as collateral will not impact the gearing ratio or the debt-to-equity ratio. Companies are expected to maintain manageable debt levels for exporters,” he added.

For exporters requiring rupiah for business activities, Airlangga stated they could take advantage of swap instruments with banks. Additionally, exporters can utilize foreign exchange swaps between banks and Bank Indonesia.

“For foreign exchange swaps between banks and BI, exporters can request banks to transfer their export proceeds in foreign currency into a BI sell swap if they need rupiah for domestic business activities,” Airlangga explained.

Exporters can also use foreign currencies to pay state levies, taxes, royalties, and dividends. Airlangga noted that such use of foreign currencies will be considered a deduction from the mandatory placement of DHE.

“In response to this policy, the Government will soon revise Government Regulation No. 36, which will take effect on March 1 of this year. Therefore, BI, the Financial Services Authority, banks, and customs authorities will prepare the necessary systems, and we will provide outreach to stakeholders,” he concluded. (BPMI of Presidential Secretariat/ABD) (AS/MUR)